Opening an account on a cryptocurrency exchange is the most common way to begin trading cryptocurrencies and other digital assets. In contrast to traditional markets, Bitcoin also features decentralized exchanges where purchasers can transact in the digital money in an anonymous manner.

Centralized cryptocurrency exchanges

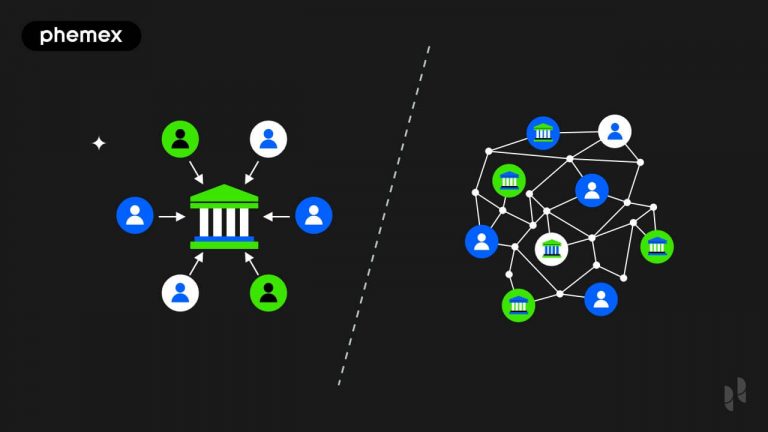

Centralized cryptocurrency exchanges act as a middleman between buyers and sellers and make money from transactional commissions and fees. It is possible to think of a CEX as a stock exchange for digital assets. Today’s most well-known exchanges, notably Phemex, are centralized.

Advantages & Disadvantages of CEX

Advantages

- Insurance and Reliability

Centralized exchanges offer greater security and dependability for trades and transactions. Most of the leading CEXes keep the vast majority of the assets belonging to its users in cold storage and implement a variety of security measures to reduce the danger of hacker assaults.

- Easy-to-use

CEXs give newbies a familiar, comfortable way to trade and invest in cryptocurrencies. Instead than managing peer-to-peer transfers and crypto wallets, which can be difficult, CEX customers can simply log into their accounts, check the status of their accounts, and make transactions through applications and websites. A crypto OTC desk, which facilitates over-the-counter cryptocurrency trading, is often utilized by institutional investors seeking large-volume trades outside of traditional exchanges.

- Extra Services

CEXs typically give their consumers additional trading alternatives in addition to the primary trading capabilities. One of the additional benefits of CEXes like Phemex, for instance, is the possibility to leverage your investments using borrowed cash from the exchange.

Disadvantages

- Higher risk of hacker attacks

As we all know, CEXes are responsible for the assets of their clients. Cryptocurrencies held by large exchanges are typically worth billions of dollars, making them a tempting target for theft and hacking.

- Manipulation and less privacy

When you grant an exchange access to your private keys, you give up some of your control over your money. A few centralized exchanges have been accused of insider trading, fabricating volume, and manipulating prices to profit from their non-transparent nature

Decentralized Crypto Exchanges (DEX)

Another type of exchange is a decentralized exchange (DEX), which allows peer-to-peer transactions directly from your digital wallet without the use of a middleman. Smart contracts based on the blockchain, which are self-executing pieces of code, power these exchanges.

Advantages & Disadvantages of DEX

Advantages

- Custody and Security

Users of decentralized exchanges are not required to transfer their funds to a third party. As a result, deliberate fraud and covert manipulation are less likely. Furthermore, most decentralized exchanges use some kind of distributed hosting to reduce the risk of intrusion and assaults.

- Transparency

Peer-to-peer cryptocurrency trading on decentralized exchanges reduces market manipulation by protecting users from fraudulent and wash trading. DEX users have more direct control over their money.

- More Privacy and Listing Diversity

Users of decentralized exchanges benefit from privacy and anonymity because no know-your-customer (KYC) forms are required of them. More cryptocurrencies and digital assets are often available through DEXs. In reality, DEXs are the only places where a lot of Altcoins are traded.

Disadvantages

- Insufficient fiat payments

DEXs are ideal for investors that want to switch between different digital assets. When using a DEX, on- and off-ramping using fiat currency is complicated. They become less useful for consumers who have not yet acquired cryptocurrency.

- Complexity

Users of decentralized exchanges must keep updated records of their digital currency wallet passwords and keys, or their assets may be irreversibly lost and irrecoverable. While centralized exchanges are more convenient and user-friendly, DEX users must first become acquainted with the platform and procedure.

Conclusion: CEX or DEX, how to choose?

Ownership is the primary distinction between centralized and decentralized exchanges, but they additionally vary with regard to functionality, security, and user experience. Decentralized exchanges may be favored by experienced traders and DeFi-native crypto enthusiasts, although younger traders may benefit more from a CEX’s spot trading features, derivatives, and ease of use. It’s recommended to conduct some research before making an investing decision.